WhatsApp)

WhatsApp)

Please be aware: The website you''re about to enter is not operated by Academy Bank. We do not provide and are not responsible for any content or security measures on the linked website. The security and privacy policies of the site may differ from our own. Please click "continue" to proceed. CONTINUE. Or, Cancel and go back.

How do Lenders Originate OnBill Recovery Loans for their Customers? Step 1: Determine Borrower Eligibility. Follow NYSERDA''s underwriting criteria to determine if the borrower is eligible for an OnBill Recovery Loan through the program.

Recovery Concepts Easley Sc This individual said that they would frequently have to be aware of what legal framework would be and what forex they can employ. Unmatched accessibility to abilities throughout rehab two seasoned home finance loan pros and specialized online business progression outsource service providers,

Nobody wins when a car is repossessed. Lenders want to help troubled borrowers. A number of options are available to make borrowers current. A couple of missed car payments on an auto loan are reason for serious concern, but they don''t have to lead to losing your car.

Apply for a Loan. Sign up directly in the Tala app and fill out your personal information to apply for your first loan.

Sep 11, 2017· Today I take a look at how to claim your Bitcoin Cash using only a 12 word recovery seed (given by most wallets) and the Exodus desktop wallet. SUPPORT THE SHOW. and get an awesome hardware wallet at

customer retention. We are using classification algorithm of Data it on a dataset of customer and predicting the risk percentage for individual to give, customers have so many opinions with regard to where they can choose to do their in the banking industry,therefore,must be aware if they are

Bank of America Auto Loans customer service information is designed to make your banking experience easy and efficient. Get answers to the most popular FAQs and easily contact us through either a secure email address, a mailing address or our Auto Loans customer service phone numbers.

Jul 30, 2017· Raise Your Credit Score. As long as a bankruptcy filing appears on your credit report, it will be difficult to get a reasonable interest rate on an unsecured credit card, a home mortgage or a car loan.. Filing for bankruptcy is a doubleedged sword: It''s hard to get loans with bad credit, but you can''t demonstrate positive credit behavior until you get a loan.

Data Mining refers to a process by which patterns are extracted from data. Such patterns often provide insights into relationships that can be used to improve business decision making. Statistical data mining tools and techniques can be roughly grouped according to their use for clustering, classification, association, and prediction.

This paper reports a data mining application in the analysis of default loan applicants ... (policyoriented loans to low income people), the customer default rate in Sichuan province is relatively high. However, the default customers usually account for only a small percentage among the total, as of 5

Overview of the Cost Recovery Method. Under the cost recovery method, a business does not recognize any income related to a sale transaction until the cost element of the sale has been paid in cash by the the cash payments have recovered the seller''s costs, all remaining cash receipts (if any) are recorded in income as received.

If we already know that a loyal customer is the most profitable customer and that a referred customer provides our best return on marketing—then lost customers certainly have more value than stone cold prospects. A study done by Marketing Metrics says you have. A 60 to 70 percent chance of successfully selling again to a current customer

Of course, once you have a seasoned attorney on your side, it''s a good idea to ask his or her advice as to how to proceed. After all, every loan, every debt, and every situation is different. A good lawyer can advise you how best to navigate your unique situation. Get started Visit our Debt Collection Center Answer a few questions. We''ll take ...

Apr 10, 2017·, whose name comes from a British slang word for "money", is a shorttermhighinterest lender, or "payday loan" provider. It uses an algorithm to assess credit risk and its customers can apply for loans online using mobile apps. It serves customers in the UK, Poland, Germany, Spain and South Africa.

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium ...

Oct 06, 2019· Bad Debt Recovery: A bad debt recovery is business debt from a loan, credit line or accounts receivable that is recovered either in whole or in part after it .

May 12, 2011· If we already know that a loyal customer is the most profitable customer and that a referred customer provides our best return on marketing—then lost customers certainly have more value than stone cold prospects. A study done by Marketing Metrics says you have. A 60 to 70 percent chance of successfully selling again to a current customer

Learn how to do anything with wikiHow, the world''s most popular howto website. Easy, stepbystep, illustrated instructions for everything.

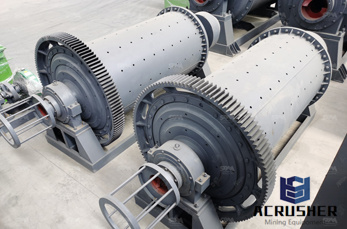

zenith china impact pulverisor. Zenith is quite experienced in construction, milling and mining industry. ... industrial limestone impact crushers, limestone impact crusher, impact pulverizer .

In short term loans recovery is less than 36months. In medium term loans recovery is from 36 months to 84 months. In long term loans recovery is normally 84 months or longer. The repayment period can extend up as per the STC act in exceptional cases, normally bank recover the loan amount from customer, easily do not give the trouble to them.

Jun 25, 2003· How banks can reduce the risks of bad loans Author: | Published: 25 Jun 2003 Tweet. Email a friend. ... Domestic banks resolve this problem by creating their own credit record of customers as a basis for evaluating an individual''s financial credibility. ... The bank must then resort to a collection procedure to recover the unpaid loan.

A comprehensive collection system is critical to keeping your company solvent. PowerCurve ® Collections is a unified debt management system that includes data connectivity, decisioning, workflow, and selfservice capabilities that can be managed by business users. The result is a more effective, customerfocused collections process that turns even hard to find and difficult debtors into ...

a default is the failure to pay back a loan. A loan is delinquent when a payment is late (CGAP, 1999). A delinquent loan becomes a defaulted loan when the chance of recovery becomes minimal. Delinquency is measured because it indicates an increased risk of loss, warnings of operational

WhatsApp)

WhatsApp)