WhatsApp)

WhatsApp)

CA Sandeep Kanoi. In this Article we have compiled depreciation rates Under Companies Act 2013 under Written Down Value (WDV) Method and as per Straight Lime method (SLM). We have also compiled Changes to Schedule II Useful Lives to Compute Depreciation read with section 123 of Companies Act,2013 made vide Notification 237(E) Dated and Notification .

depreciation is permitted (indicated by NESD in Part C above), if an asset is used for any time. during the year for double shift, the depreciation will increase by 50% for that period and in. case of the triple shift the depreciation shall be calculated on the basis of for that. period. 7.

Mar 15, 2016· Can anyone pls tell me what is the rate of depreciation on weighting machine as per income tax because it is a firm So I dnt think that companies act depreciation rate will be provided .

Jan 01, 2007· Depreciation Rates. Machinery. ... Effective Life Diminishing Value Rate Prime Cost Rate Date of Application; AGRICULTURE, FORESTRY AND FISHING: Sheds on land that is used for agricultural or pastoral operations (including machinery sheds, workshop sheds ... Grinding machines (including gear grinding machines) 10 years: %: %: 1 Jul ...

Rate Of Depreciation On Crusher Machine As Per Income Tax Act depreciation rates . Get Price And Support Online; DEPRECIATION UNDER GAAP (FOR BOOK PURPOSES) = rate x 6,000 total acquisition cost = 3,000 acquisition cost for the computer 2. . annual depreciation expense in the earlier years of the asset''s life and.

Dec 23, 2019· As Per New Companies Act 2013 Depreciation Is Charges As Per Schedule II Of Companies Act 2013. Recently we are Provide Depreciation Rate Chart as Per Income Tax Act for 201617, Procedure for Online E Registration of Service Tax, Income Tax Due Dates July 2015, Calculation of depreciation using WDV method if date of acquisition is missing ...

Also know depreciation as per companies act 2013 for fy 201819. Checkout the Rate Table of Depreciation Rates for Financial Year 201819 as per Indian Income Tax Act. Also know depreciation as per companies act 2013 for fy 201819. ... Heart lung machine .

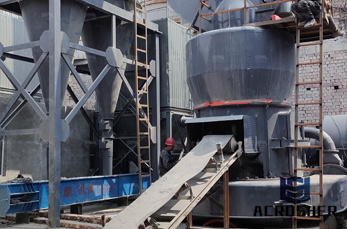

depreciation rates as per companies act of coal crusher . depreciation rates as per companies act of coal crusher heavy industry is specialized in the design manufacture and supply of crushing equipment used in mining industry The product range of our company comprises mobile crushing plant jaw crusher cone crusher impact crusher milling ...

Nov 03, 2014· Rate of Depreciation as per Companies Act Depreciation under Companies Act, 2013. ... machines, editing machines, synchronizers and studio lights except bulbs. 13 Years. 2. Projecting equipment for exhibition of filmsdo(b) Plant and Machinery used in glass manufacturing. 1.

Depreciation is Calculated as per the provisions of income tax act for income tax return and companies are calculated as per companies act. So Depreciation is calculated by two method one is as per companies act or one is as per income tax act. Today we provide depreciation chart as per income tax act for easily calculate depreciation.

Sep 04, 2016· Depreciation Calculation as per Companies Act 2013 As per companies act 2013, the depreciation is calculated on the basis of useful life of asset. Schedule II of companies act 2013, provides for useful life of depreciable assets which can be used to calculate depreciation based on WDV and SLM method.

03 August 2012 How many % of Depreciation charged on Zerox Fax machines as per Income Tax Act 1961.

Depreciation rates as per income tax act for the financial years 201516 201617 are given below. A list of commonly used depreciation rates is given in a TaxAdda TaxAdda provides updated information about tax laws in India.

Do you want to know the Depreciation rate chart companies act 2013 . These are based on useful lives of assets as per companies act 2013, download it . rate of depreciation as per income tax act . Deduction Unit For Grinding Mill "rate of depreciation as per companies act for grinder machine. depreciation is an income tax ...

b. depreciation rates or the useful lives of the assets, if they are different from the principal rates specified in the Schedule. 6. The calculations of the extra depreciation for double shift working and for triple shift working shall be made separately in the proportion which the number of days for which the concern worked double shift

Jul 02, 2015· Want to know the useful lives of depreciation under companies act 2013? This post has the tabular format of useful lives of all Assests as per section 123. Leading site in Income tax, investment, personal finance, Tds, Accounts and in corporate Law.

Jun 04, 2016· Accordingly rates are calculated in the following Depreciation rate chart companies act 2013. Note that depreciation rate as per WDV method will always change since they depend on cost of the asset. Note that depreciation rate as per WDV method will always change since they depend on cost of the asset.

Jan 19, 2012· As per Notes appended to the Rates of Depreciation under the Companies Act as mentioned in Schedule XIV— "4. Where, during any financial year, any addition has been made to any asset. the depreciation on such assets shall be calculated on a .

Depreciation Calculator for Companies Act 2013. Depreciation as per companies act 2013 for Financial year 201415 and thereafter. These provisions are applicable from vide notification dated . Depreciation is calculated by considering useful life of asset, cost and residual value.

Thanks for A2A. Basically the main difference in the calculation of depreciation under Income Tax Act and The Companies Act is that of the methods to be adopted for the purpose of computation. Under Income Tax Act 1961, depreciation on assets is g...

Depreciation Rate Chart as per Part "C" of Schedule II of The Companies Act 2013 Nature of Assets Useful Life Rate [SLM] Rate [WDV] (viii) Plant and Machinery used in manufacture of non ferrous metals 1 Metal pot line [NESD] 2 Bauxite crushing and grinding section 3 Digester Section [NESD] 4 .

depreciation rates as per companies act of coal crus. depreciation rates as per companies act of coal crus. ... depreciation on crusher plant company. depreciation on crusher plant company. depreciation on crusher plant company. depreciation rates as per companies act of crushing machine project report for grinding in india,start up plan.

Jun 23, 2015· PART C OF SCHEDULE II OF COMPANIES ACT 2013

Tags : Rates of depreciation (for IncomeTax) for AY 1819 or FY 1718, income tax depreciation rates for ay 201718 pdf, depreciation rates for ay 201819, depreciation rates as per income tax, depreciation rate chart, how to calculate depreciation as per income tax act, depreciation rates on fixed assets, depreciation rates as per companies act, computer depreciation rate for ay 201819, .

WhatsApp)

WhatsApp)